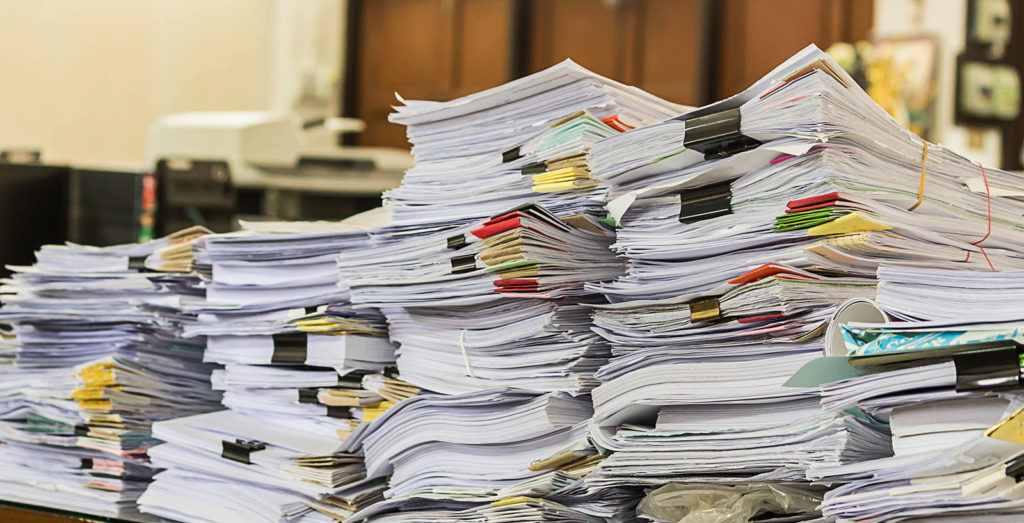

According to a recent report by the International Chamber of Commerce, as COVID-19 reveals the shortcomings of a paper-based trade system, financial institutions (FIs) are finding ways to keep trade circulating.

It says that the problem being faced today is rooted in trade’s single most persistent vulnerability: paper.

Paper is the financial sector’s Achilles heel.

The disruption was always going to happen, the only question was, when.

Preliminary ICC data shows that financial institutions already feel they are being impacted.

More than 60% of respondents to the recent COVID-19 supplement to the Trade Survey expect their trade flows to decline by at least 20% in 2020.

The pandemic introduces or exacerbates challenges to the trade finance process.

To help combat the practicalities of trade finance in a COVID-19 environment, many banks indicated that they were taking their own measures to relax internal rules on original documentation.

However, only 29% of respondents report that their local regulators have provided support to help facilitate ongoing trade.

It’s a critical time for infrastructure upgrades and increased transparency, and while the pandemic has caused a lot of negative effects, a potential positive impact is that it has made clear to the industry that changes do need to be made to optimize processes and improve the overall functioning of international trade, trade finance, and money movement.

Ali Amirliravi, the CEO of LGR Global of Switzerland and founder of Silk Road Coin, explained how his firm has found solutions to these problems.

Ali Amirliravi, the CEO of LGR Global of Switzerland and founder of Silk Road Coin

“I think it comes down to integrating new technologies in smart ways. Take my company for example, LGR Global, when it comes to money movement, we are focused on 3 things: speed, cost & transparency.

“To address these issues, we are leading with technology and using things like blockchain, digital currencies and general digitization to optimize the existing methodologies.

“It’s quite clear the impact that new technologies can have on things like speed and transparency, but when I say it’s important to integrate the technologies in a smart way that’s important because you always have to keep your customer in mind – the last thing we would want to do is introduce a system that actually confuses our users and makes his or her job more complicated.

“So on one hand, the solution to these problems is found in new technology, but on the other hand, it’s about creating a user experience that is simple to use and interact with and integrates seamlessly into the existing systems.

“So, it’s a bit of a balancing act between technology and user experience, that’s where the solution is going to be created.

“When it comes to the broader topic of supply chain finance, what we see is the need for improved digitalization and automation of the processes and mechanisms that exist throughout the product lifecycle.

“In the multi-commodity trading industry, there are so many different stakeholders, middlemen, banks, etc. and each of them have their own way of doing this – there is an overall lack of standardization, particularly in the Silk Road Area.

“The lack of standardization leads to confusion in compliance requirements, trade documents, letters of credit, etc., and this means delays and increased costs for all parties. “Furthermore, we have the huge issue of fraud, which you have to expect when you are dealing with such disparity in the quality of processes and reporting.

“The solution here is again to use technology and digitalize and automate as many of these processes as possible – it should be the goal to take human error out of the equation.

“And here is the really exciting thing about bringing digitalization and standardization to supply chain finance: not only is this going to make doing business much more straightforward for the companies themselves, this increased transparency and optimization will also make the companies much more attractive to outside investors. It’s a win-win for everyone involved here.

So, how does Amirliravi believe these new systems can be integrated into existing infrastructure?

“This is really a key question, and it’s something that we spent a lot of time working on at LGR Global.

“We realized you can have a great technological solution, but if it creates complexity or confusion for your customers, then you’ll end up causing more problems than you solve.

“In the trade finance and money movement industry, that means that new solutions have to be able to plug in directly into existing customer systems –using APIs this is all possible.

“It’s about bridging the gap between traditional finance and fintech and making sure that the benefits of digitalization are delivered with a seamless user experience.

“The trade finance ecosystem has a number of different stakeholders, each with their own systems in place.

“What we really see a need for is an end-to-end solution that brings transparency and speed to these processes but can still interact with the legacy and banking systems that the industry relies on.

“That’s when you’ll start to see real changes being made.”

When asked where are the global hotspots for change and opportunities Ali Amirliravi said that his company, LGR Global, is focusing on the Silk Road Area – between Europe, Central Asia and China – for a few main reasons:

“First, It’s an area of incredible growth.

“If we look at China for example, they have maintained GDP growth of over 6% for the last years, and central Asian economies are posting similar numbers, if not higher.

“This kind of growth means increased trade, increased foreign ownership and subsidiary development.

“It’s an area where you can really see the opportunity to bring a lot of automation and standardization to the processes within the supply chains.

“There is a lot of money being moved around and new trading partnerships being made all the time, but there are also a lot of pain points in the industry.

“The second reason has to do with the reality of currency fluctuation in the area.

“When we say Silk Road Area countries, we are talking about 68 countries, each with their own currencies and the individualized value fluctuations that come as a by-product of that.

“Cross-border trade in this area means that the companies and stakeholders that participate in the finance side have to deal with all kinds of problems when it comes to currency exchange.

“And here is where the banking delays that happen in the traditional system really have a negative impact on doing business in the area: because some of these currencies are very volatile, it can be the case that by the time a transaction is finally cleared, the actual value that is being transferred ends up being significantly different than what might have been agreed to initially.

“This causes all kinds of headaches when it comes to accounting for all sides, and it’s a problem that I dealt with directly during my time in the industry.”

Amirliravi believes that what we are seeing right now is an industry that is ready for change.

He said: “Even with the pandemic, companies and economies are growing, and there is now more of a push toward digital, automated solutions than ever before.

“The volume of cross-border transactions has been growing steadily at 6% for years now, and just the international payments industry alone is worth 200 Billion Dollars.

“Numbers like that show the impact potential that optimization in this space could have.

“Topics like cost, transparency, speed, flexibility and digitization are trending in the industry right now, and as deals and supply chains continue to become more and more valuable and complex, demands on infrastructure will similarly increase.

“It’s really not a question of “if”, it’s a question of “when” – the industry is at a crossroads right now: it’s clear that new technologies will streamline and optimize processes, but parties are waiting for a solution which is secure and reliable enough to handle frequent, high volume transactions, and flexible enough to adapt to the complex deal structures that exist within trade finance. “

Amirliravi and his colleagues at LGR Global see an exciting future for the b2b money movement and trade finance industry.

He said: “I think something that we are going to continue to see is the impact of emerging technologies on the industry.

“Things like blockchain infrastructure and digital currencies will be used to bring added transparency and speed to transactions. Government-issued central bank digital currencies are also being created, and this is also going to have an interesting impact on cross-border money movement.

“We’re looking at how digital smart contracts can be used in trade finance to create new automated letters-of-credit, and this gets really interesting once you incorporate IoT technology.

“Our system is able to trigger transactions and payments automatically based on incoming data streams.

“This means, for example, that we could create a smart contract for a letter of credit which automatically releases payment once a shipping container or a shipping vessel reaches a certain location.

“Or, a simpler example, payments could be triggered once a set of compliance documents is verified and uploaded to the system.

“Automation is such a huge trend – we’re going to see more and more traditional processes being disrupted.

“Data is going to continue to play a huge role in shaping the future of supply chain finance. In the current system, a lot of data is siloed, and the lack of standardization really interferes with overall data collection opportunities.

“However, once this problem is solved, an end-to-end digital trade finance platform would be able to generate big data sets that could be used to create all kinds of theoretical models and industry insights.

“Of course, the quality and sensitivity of this data means that data management and security will be incredibly important for the industry of tomorrow.

“For me, the future for the money movement and trade finance industry is bright. We’re entering the new digital era, and this is going to mean all kinds of new business opportunities, particularly for the companies that embrace next generation technologies.”